The central bank digital currency (“CBDC”) race has begun. CBDC is electronic, universally accepted, central bank-issued money. Central banks across the globe are undertaking extensive work on CBDC. It has moved from a bold speculative concept to a seeming inevitability. According to a recent survey by the Bank for International Settlements, 80% of central bank respondents are engaged in CBDC projects. Central banks representing a fifth of the world’s population say that in the next few years, they are likely to issue CBDCs. Technology firms are actively proposing novel CBDC solutions during central bank tenders. In this blog, we will outline why ProximaX’s solution is a holistic and winning formula.

The ProximaX CBDC solution:

1. Ecosystem design:

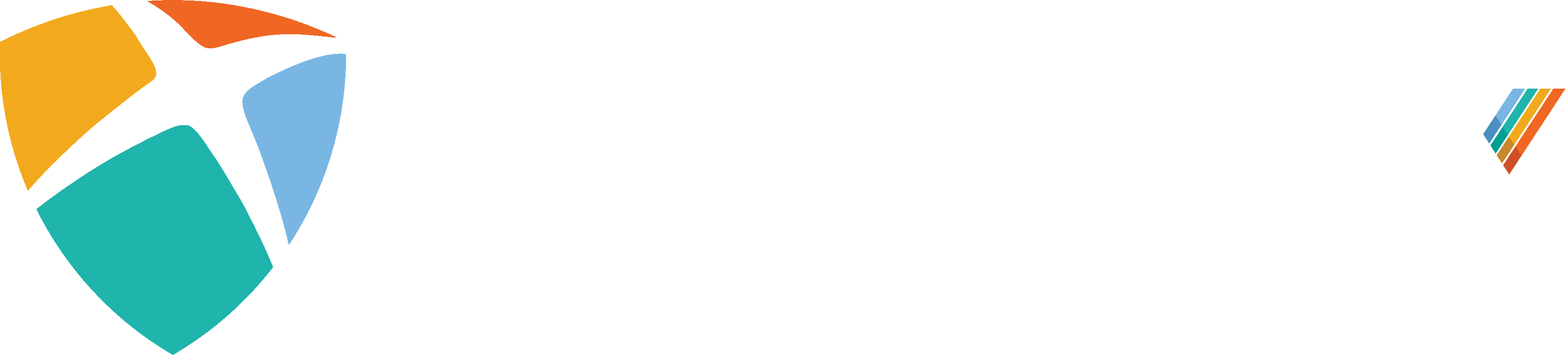

The ProximaX design consists of a multi-layer topology among CBDC ecosystem players with a framework and protocol where different parties can cross-transact with one another transparently and seamlessly.

Under this approach, central banks will issue CBDC to financial institutions–just as they now do with cash–and financial institutions would distribute these to individuals and businesses by setting up and managing digital wallets. Each financial institution will have its ledger, and transaction activities will remain private and confidential within the financial institution except for visibility by a central bank or financial regulators.

Central banks would also have the option of providing digital wallets to serve the unbanked directly.

Figure 1. Cross-ecosystem traversal of CBDC

2. Core features:

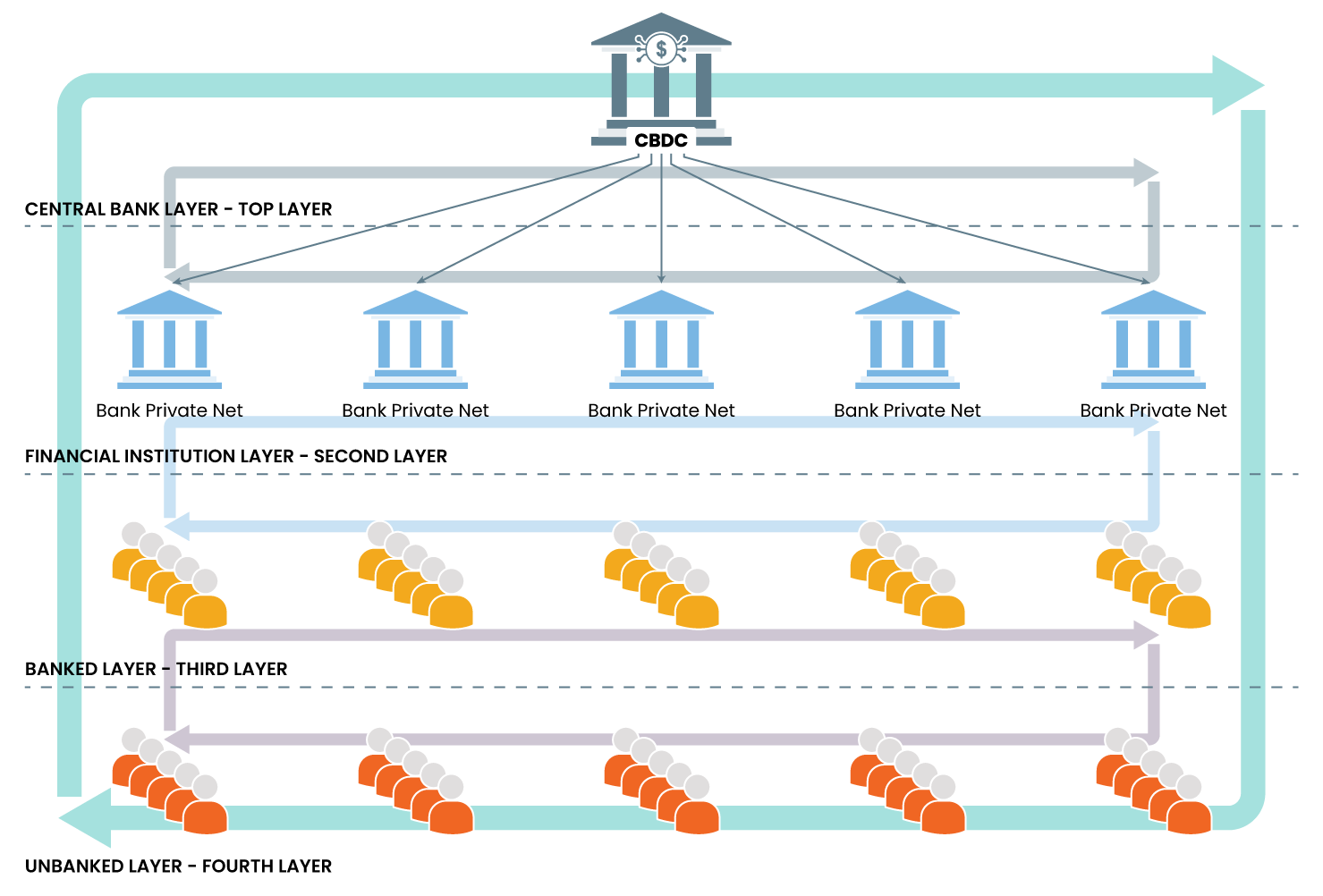

ProximaX CBDC is powered by the ProximaX Sirius infrastructure and development platform, which consists of a stack of enterprise-grade distributed, and decentralized technologies: storage, streaming, database, Supercontracts, and blockchain.

The platform uses a hub and spoke approach for each service layer so that they are independent of one another, apart from relying on the blockchain as a hub for transaction records. This superior architecture makes the platform highly scalable, as central banks and financial institutions can include more service layers without affecting the platform’s performance.

Utilizing the ProximaX Sirius platform, financial institutions can quickly integrate their solutions with CBDC. The platform has every service layer needed to create any application. Access to the platform can easily be granted via its APIs and through the use of SDKs.

Figure 2: ProximaX Sirius platform

Specific features for the ProximaX CBDC ecosystem include:

-

Account restrictions: Restriction rules make it possible to receive transactions only from a list of permitted addresses. This can be used to ensure only KYC-approved users can transact with one another.

-

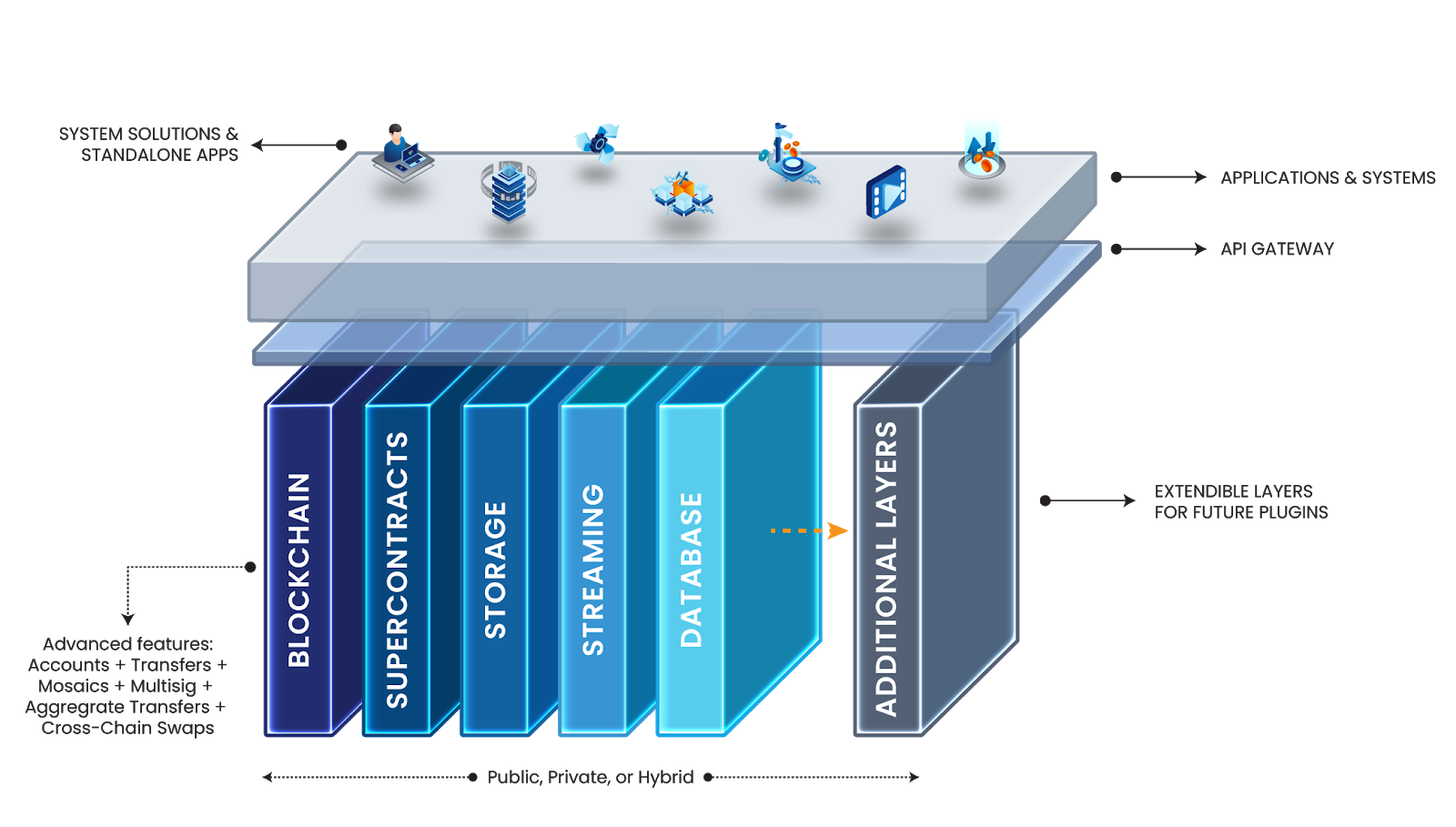

Multi-level multi-signature accounts: Multi-signature is a cosignatory agreement between account signatories (e.g., how many need to sign to execute a transaction or remove a signatory). Multi-level multi-signature enables multiple levels of agreements between co-signatories, making it useful for comprehensive transaction approval processes.

Figure 3. Multi-level multi-signing of a transaction

-

Aggregate transactions: An aggregate transaction merges multiple CBDC transactions into one, allowing trust-less swaps, escrows, and other advanced logic. Once all signatories sign the transaction, the exchange automatically and irrevocably executes.

-

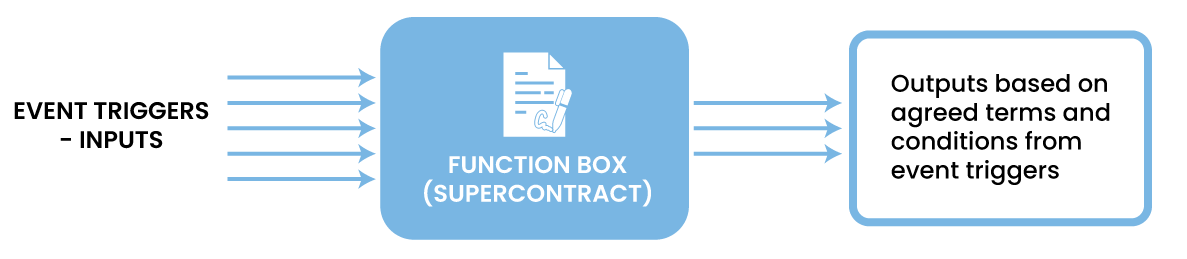

Supercontracts: A Supercontract is an improved smart contract where self-executing logic is located off-chain in the ProximaX Sirius storage layer. Authorized parties can quickly and easily stop, amend, and restart a Supercontract upon reaching consensus.

A Supercontract is a function box that can be programmed to trigger the execution of specific actions upon the occurrence of some agreed event(s). These events could be a date (e.g., when interest is due), the occurrence of an agreed action (e.g., upon delivery, or a result), or when a particular monetary policy gets triggered.

Figure 4. A typical representation of a Supercontract

Additionally, CBDC can be programmed with Supercontracts to implement KYC/AML procedures into the CBDC itself, which streamlines the efficacy of regulatory compliance policies.

-

Metadata: Data can be attached to the CBDC, or an account to add additional information. Metadata is useful for producing faster system performance by making it possible to do off-chain actions using metadata. For example, financial institutions can apply metadata to blacklisted and special accounts where transactions are barred or permitted.

-

Cross-chain swaps: Also known as atomic swaps, this is a secure way to perform cross-ledger CBDC transactions between financial institutions where each has a private and independent network.

3. Digital identity:

Authorities can ensure that every CBDC account is linked to a digital identity on the ledger. Authorized parties can then observe CBDC records and trace any illicit actions made by the owner of a digital identity. Combining the use of digital identity with CBDC can significantly reduce KYC compliance, curb tax evasion, and provide vital data for improved central bank monetary and fiscal policies.

ProximaX SiriusID, a W3C-compliant state-of-the-art digital identity solution that uses the self-sovereign identity (“SSI”) security is used for this. As a complete plug-n-play stack, it is a blockchain-powered platform that allows authorized parties to develop any digital identity solution.

With SiriusID, trusted parties (e.g., the government and regulated entities) can peg digital identities with credentials and extended identity data (e.g., national ID number; passport copy; source of wealth data). The system records the digital identities and credentials on the ledger, which verifiers can trust. When external parties verify a user’s digital identity, the SiriusID owner can reveal personally identifiable data (“PID”) or remain anonymous.

ProximaX has developed the SiriusID white-label app, which can be customized by public bodies and private enterprises.

Figure 5: ProximaX SiriusID mobile app

4. Digital wallets:

A ProximaX CBDC solution comes with a mobile application for Android and iOS. This solution, the mWallet, provides users with a window to the CBDC financial system.

Features include:

- Recovery of CBDC when the wallet is lost or stolen.

- The setting of maximum CBDC transactions per day (can be tied to KYC credentials).

- Smart device doubling up as a POS machine.

- Where physical banknotes are still in use, CBDC top-up, which could be used by an agent to exchange CBDC for banknotes.

- Bill payment and remittance.

Figure 6: ProximaX mWallet mobile app

ProximaX can also customize its existing Sirius desktop wallet and explorer for use by central banks to create, issue, and manage CBDC, including generating real-time statistical reports.

Summary:

The ProximaX CBCD solution is a technology stack comprising multiple layers of services specifically designed to address many of the problems faced by central banks wanting to implement a holistic solution. It addresses well the following pain points:

- In-built real-time gross settlement system with no gridlock or deadlock.

- Ensures transaction privacy between financial institutions.

- An open system that allows plug-ins, such as transaction monitoring and screening using AI.

- Fast transfers and decentralized payments catering for higher transaction volumes.

- Messaging solution using ISO20022/SWIFT.

- Payment finality.

- Highly scalable.

- Allows central banks to issue CBDC based on independently defined monetary policies.

- Gives financial institutions the ability to offer new financial services to individuals, which are otherwise offered to institutional investors.

- Scalable to include forex and international settlement, especially if collective central banks use the same framework and protocol as the ProximaX solution.

- Lost wallets or stolen money can be recovered or reversed by financial institutions upon detecting fraud or theft.

- Financial inclusion of the unbanked.

- Every transaction is monitored and approved.

- Supercontract solutions giving financial institutions breadth and depth in their service offerings.

- Seamless integration into the ProximaX eDLX platform for security exchange, substantially reducing complicated regulatory requirements.

- Comprehensive SDKs and APIs to connect to external services.

- A neobanking entity can easily and immediately make use of the framework and protocol to offer banking services.

Contact us:

To find out more, email info@proximax.ltd and visit www.proximax.ltd.